This initial process requires a detailed understanding of your present situation by:

There is often more than one strategy that emerges from stage 1.

Understanding the level of risk that you are comfortable with is critical, for example:

The only certainty in investing is continuous change:

In these uncertain times and the global economic downturn, the question of how to protect your capital, achieve the growth that you require, and manage any risk will be uppermost in your mind.

Let us help you.

Ethical Investing provides you with an extra layer of analysis by evaluating the environmental, social and governance (ESG) material risks associated with your investments. This allows for a holistic assessment of the key material long and short-term risks and opportunities.

This is particularly relevant in these uncertain times—the bush fires, the pandemic, the recession, the social strife, and the growing climate crisis.

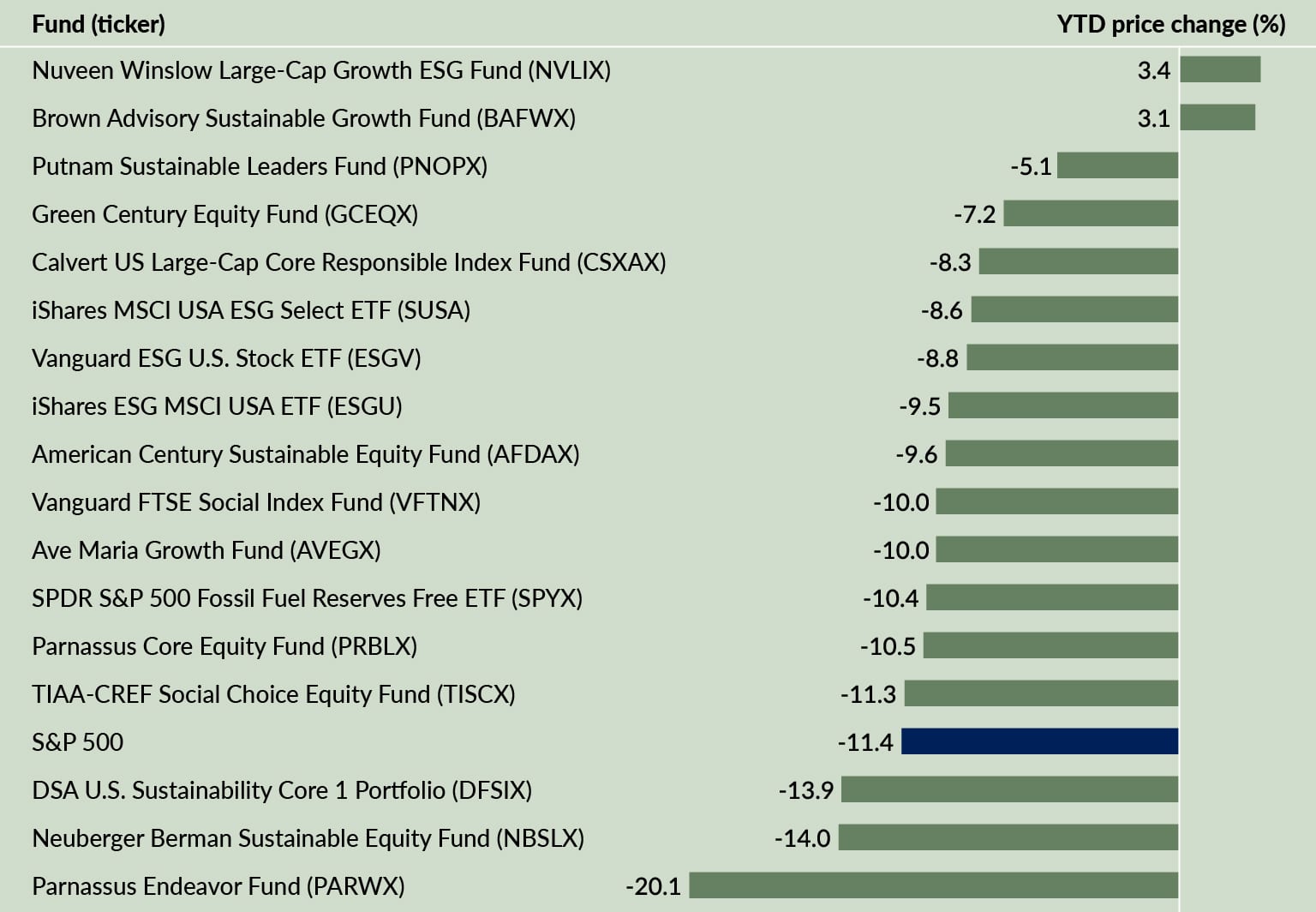

One constant throughout 2020’s parade of pandemonium is that investing in companies with high environmental, social and governance scores has been relentlessly gaining momentum. Historically, Ethical or ESG investing has been sidelined during trying economic times, largely for fear that it would tamp down returns. But recent data has shown quite the opposite. ESG funds are outperforming the overall market.

In a June 2020 overview GreenBizz gathered relevant statistics to global ESG performance and growth:

So, money is pouring into ESG investments largely because they produce higher short and long-term yields and are seen as less risky during turbulent times. Almost a no-brainer.